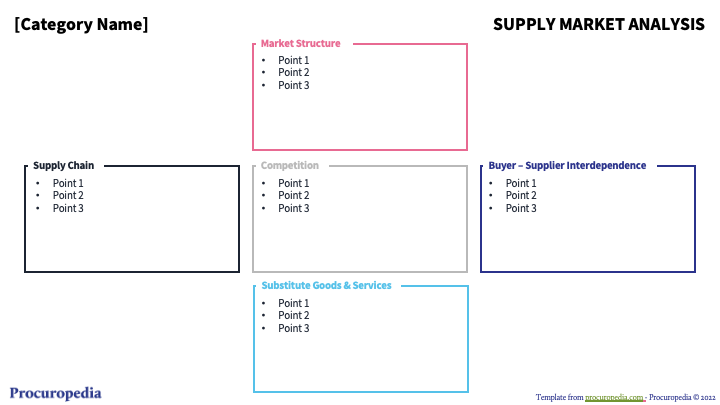

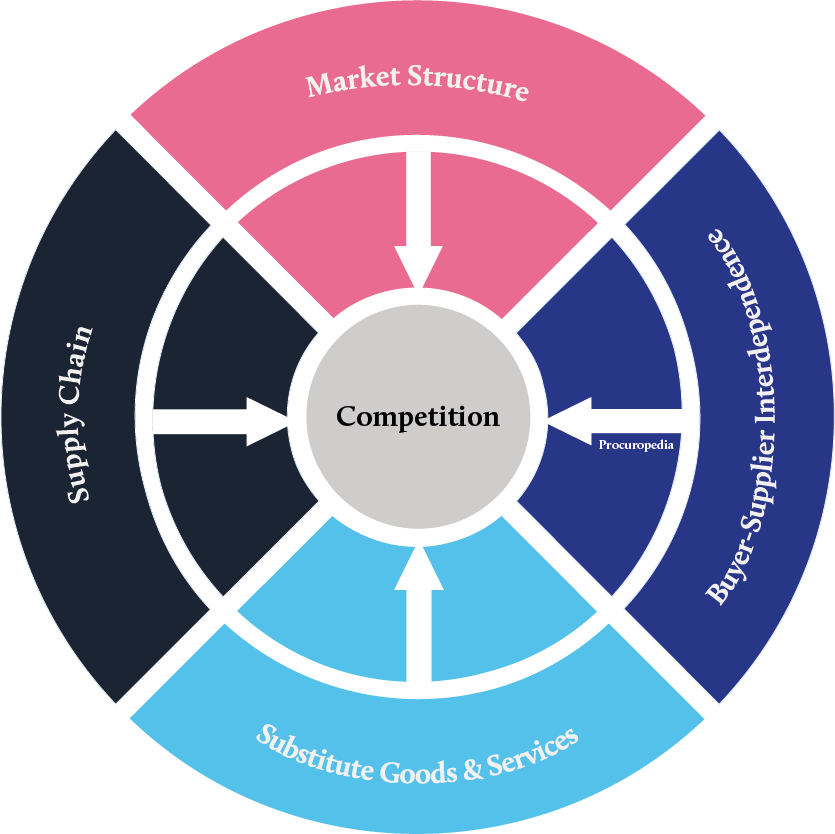

Market Structure

The first step in analyzing the market structure is to define the relevant market, which entails determining a market’s key characteristics. For instance, whether it is purely a product market, a service market, or a combination. Once the market is defined, the size of the total market is determined based on both revenue and volume. This total size may then be broken down at an international, national, or regional level.

Procurement professionals should also research and understand the pricing structure; how material costs, transportation costs, labor costs, and overheads are influencing the market and the final price.

Equally, procurement professionals should conduct a PESTLE analysis to understand the key impacts on the current performance of the market.

The next step is to determine who the key suppliers are and their respective market shares. This step is particularly important in determining the level of market concentration. Procurement professionals should also evaluate ownership structures in a market as it can help explain their behavior and availability of products. For example, what may appear as competing suppliers may in fact be a subsidiary of the other. A SWOT Analysis can be an important framework in this step to compare the relative positions of the key suppliers in a market.

Price inflation is another characteristic which reflects a supplier’s viability. Increase in the supply and competition can indicate high profitability and supply continuity, thereby reducing the risk exposure of the buying organization.

Competition

It is key to understand the relative competitive strategies of the market. Suppliers compete on different features, such as

- Price (if suppliers are offering the same generic good or service)

- Product type, service, and distribution (if these aspects enhance the product or service quality)

- Brand image (if the number of competing firms increases)

The choice of above characteristics depends upon the severity of barriers to entry and exit. When barriers to entry are high, suppliers are likely to compete on the basis of product type and brand image. When barriers are low, suppliers will lead with price-based competition.

Supply Chains

Procurement professionals should analyze the market supply chain to understand:

- If other parties are adding value in the supply chain

- If there are redundant costs in the supply chain

- What risks and dependencies are in the supply chain and how can they be managed?

This information will allow decisions to be made on where in the supply chain to buy. For instance, it may be better to buy directly from a manufacturer as opposed to a product reseller.

Substitute Goods and Services

Identifying substitute good and services can reduce the buyer’s overall degree of business risk, especially if there are:

- Monopoly markets

- Significant sustainability impacts and/or opportunities

- Special requirements, i.e., product or service that is fit for a specific/unique purpose

Analyzing the substitutes provides alternative solutions for a product. Such analysis should be conducted in consultation with the end users to confirm a substitute’s ability to meet their needs.

Alternate solutions can also increase buyers’ leverage for any negotiation as it reduces the need for one specific product and increases competition.

Buyer-Supplier Interdependence

The supplier’s perception of the buying organization has a major effect on how that supplier is likely to perform. Thus, the procurement strategies should be optimized based on the willingness or reluctance of a supplier to meet the buyer’s needs.

An important framework in this step is the Supplier Preferencing Model. It is a 2×2 matrix which defines a supplier’s perspective of the buying organization through 2 lenses:

- The attractiveness of the account to the supplier

- Relative value of business to the supplier

However, buyer power can also influence relationships with the suppliers that depend on the buyer’s requirements. A Supplier Indexing analysis examines the relative power between buyers and suppliers by combining the Kraljic Matrix with the Supplier Preferencing matrix to define 16 distinct types of buyer-seller relationships. Each of these relationships call for specific procurement strategies.