Definition

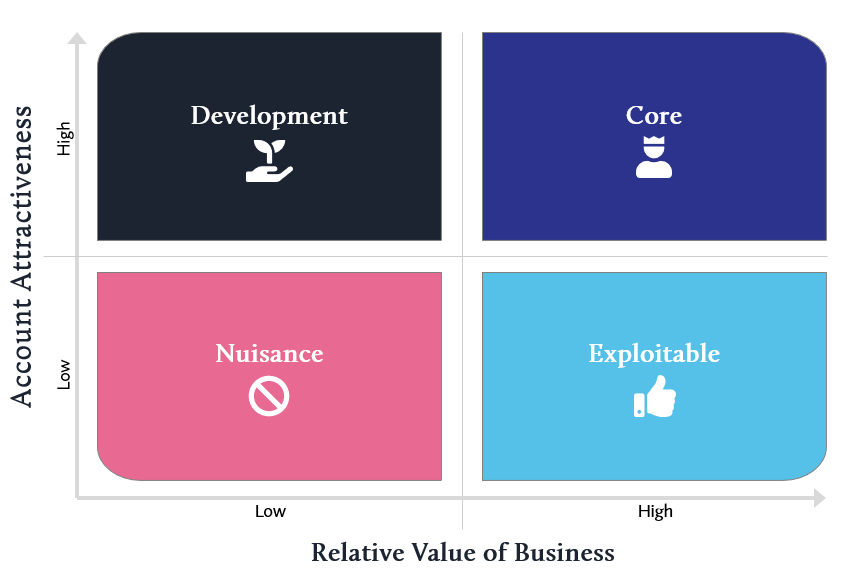

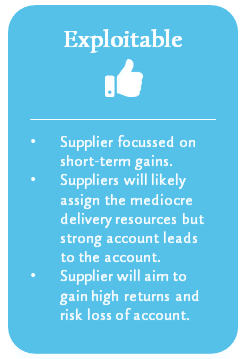

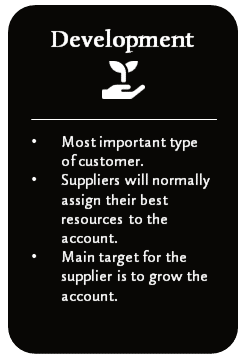

Supplier Preferencing is a method of assessing how a supplier perceives a buying organisation. The suppliers perception of the buying organisation has a major affect on how that supplier will perform. Supplier preferencing is a powerful tool that should be used across the life-cycle of a supplier relationship to continually assess whether the supplier relationship or contractual performance may suffer due to a change in their perception of the buying organisation.

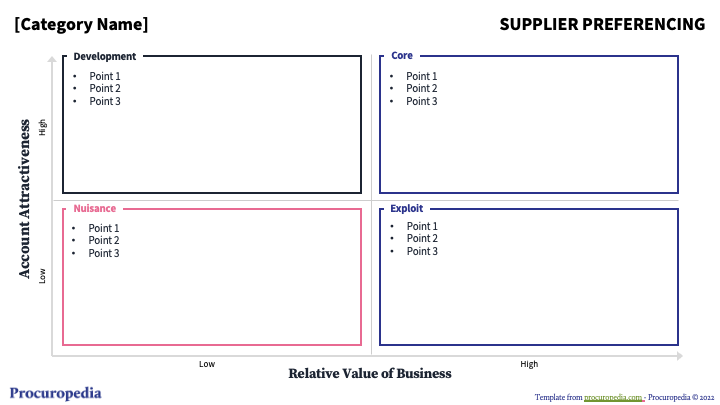

Templates

Need more help? Have a request? Please drop us a line...