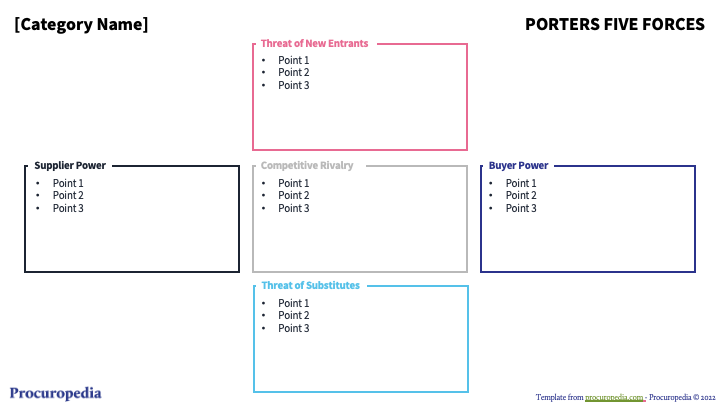

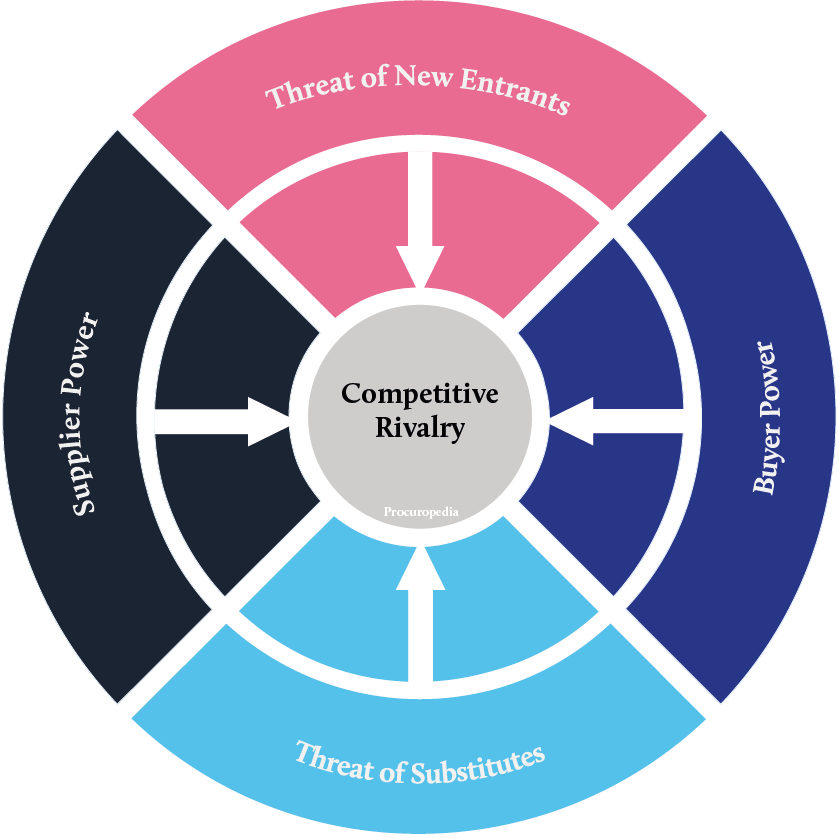

These five forces play a role in measuring industry attractiveness, profitability, and competition level. They are:

- Competitive Rivalry

The first among Porter’s Five Forces examines the number of competitors in an industry. It also analyzes their strength or ability to undermine a company. A high number of competitors with comparable products and services normally reduces a company’s power. Industries with a low number of competitors would normally increase a company’s power. When competition is high a buyer would normally be able to secure a deal that is beneficial to them, when competition is low a supplier would push for deals that suit them.

- Supplier Power

The number of suppliers of vital inputs, the uniqueness of these inputs, and the cost of switching suppliers affect the supplier power factor.

A company’s dependency on a supplier is directly proportional to the number of suppliers in the industry. The fewer the suppliers, the more dependency. Thus, giving suppliers more ability power to increase input costs or demand other trade benefits. Conversely, more suppliers or low supplier switching costs help companies minimize input costs and potentially increase organizational profits.

- Buyer Power

A company’s total number of customers or buyers, the significance of each buyer, and the cost of finding new markets or customers for outputs impact the amount of buyer power there is in a market.

Smaller numbers of buyers in a market usually command more power. Each buyer can bargain for better deals and lower prices within such a base. On the other hand, companies with a larger number of buyers will find it easier to charge higher prices.

- Threat of New Entrants

Established companies could find their position weakened if new rivals enter the market at less time and expense. Similarly, if protection for a company’s key technologies is low, new entrants could easily establish themselves as key competitors.

The ideal environment for existing companies is in an industry with strong entry barriers. Such an environment will provide them with a fair advantage in charging higher prices and negotiating better deals due to a lower number of competitors.

In procurement, it is important to assess potential new entrants to create more competition in the category or with the supplier to improve the negotiation power of an organization.

- Threat of Substitutes

A good or service that can replace a company’s products or services is an obvious threat.

Companies offering goods or services that are hard to substitute are more likely to find a favorable position. They will hold power to raise prices and settle for favorable terms. However, if close substitutes for a product are available, customers may choose to forgo purchase from the company. Thus, the company’s power weakens.

In procurement, this is also a vital aspect to improve a buying position. Having alternatives to a solution will increase the power in negotiations with suppliers.